Visa Tightens Fraud Monitoring: What Merchants Need to Know

Visa just made some important updates to the way it tracks fraud and chargebacks — and if you're a business that accepts payments, these changes matter to you.

At Dispute.com, we’re here to break it down in plain language and help you stay on top of these updates so you don’t get hit with penalties or higher fees.

What’s New in Visa’s Fraud Monitoring Program (VAMP)?

Visa uses a program called VAMP to watch for high levels of fraud and chargebacks. If a business or payment processor has too many problems, they can get flagged — and that can lead to big headaches.

Here’s what’s changed in the program:

1️⃣ The New VAMP Formula Counts Everything — and It Can Double-Count Fraud

Visa now adds up:

- All fraud reports (called TC40s)

- All chargebacks (fraud and non-fraud, called TC15s)

Then it divides that by your total number of settled transactions.

⚠️ This means the same fraud case can show up twice — once as a TC40 and again as a chargeback. Your risk score can go up fast, even if you're already trying to fix things.

2️⃣ Fraud Alerts Help — But Not as Much as Before

Tools like Ethoca, CDRN, or RDR let you refund a customer before the chargeback happens. That’s good — but even if you stop the chargeback, the fraud report (TC40) still counts against you.

💡 Bottom line: These tools help, but they won’t erase the fraud from Visa’s view.

3️⃣ The Timeline Is Moving Up

Visa will start applying stricter rules for acquirers (payment processors) sooner than expected — now June 1, 2025.

Fees for being flagged won’t start until January 2026, but the pressure is on early.

4️⃣ Visa Raised the Red Flag Thresholds

It now takes more fraud to be labeled “excessive” — but don’t get too comfortable.

- Acquirers: Threshold goes from 0.5% → 0.7%

- Merchants:

- North America, Europe, Asia, and CEMEA: From 1.5% → 2.2%

- LAC region: Stays at 1.5%

⚠️ Even if you’re not over the limit yet, you're closer than you think.

5️⃣ Program Enrollment Limits Increased

Now, individual merchants only get added to the program if:

- Their acquirer’s fraud ratio is over 0.5% (up from 0.3%)

- They have at least 1,500 fraud/chargeback cases per month (up from 1,000)

- CEMEA merchants have a lower minimum: 150 cases and at least $75,000 in fraud/dispute value

6️⃣ Action Plans Are Required If You're Flagged

If your acquirer gets flagged, they’ll get a notice and must send Visa a detailed action plan that explains what caused the issue — and how they’ll fix it — before the month ends.

7️⃣ Case Fees Got a Bit Cheaper

One small win: Visa lowered the per-case fee for being in the program — slightly.

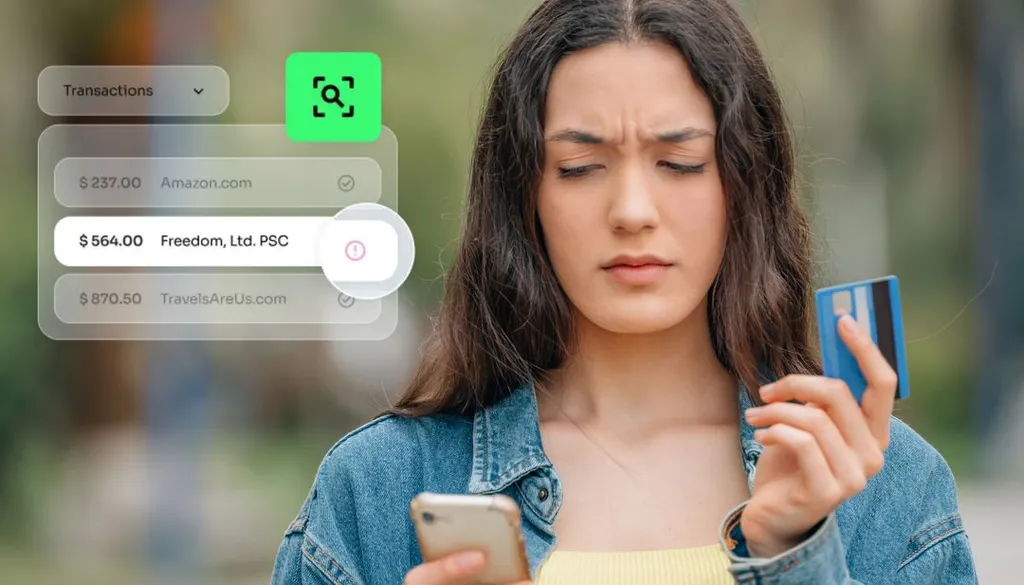

How Dispute.com Helps You Stay Safe

We make sure you’re ready for changes like this — and that you're not caught off guard.

Here’s how we help:

- 🛡 We help prevent disputes before they happen using smart fraud alerts and prevention tools

- ⚡ We speed up your response time with easy tools to fight chargebacks

- 📊 We monitor your fraud and dispute data, so you know your risk level

- 🤝 We guide you through Visa’s rules so you can stay compliant and avoid fees

✅ What This Means for You

Visa is taking a tougher stance on fraud and chargebacks. You can’t afford to ignore it — even if you're using fraud tools and have a solid team.

With Dispute.com on your side, you’ll not only stay safe — you’ll stay ahead.