Chargeback Fraud: What It Is, Types, and How to Protect Your Business

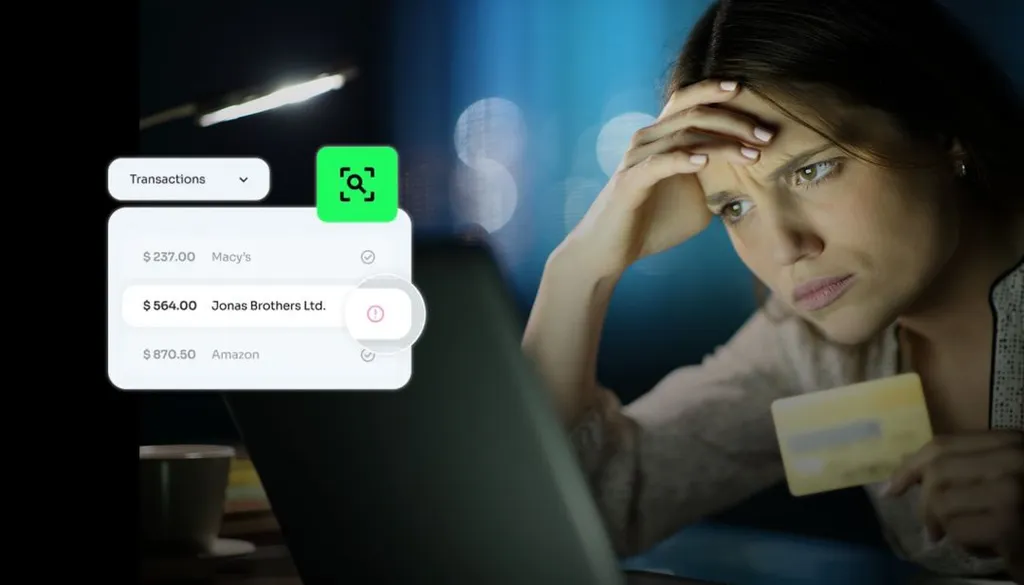

Chargeback fraud is a growing problem for businesses, costing them billions every year. In 2021, businesses lost around $20 billion due to chargeback fraud. This type of fraud occurs when a customer disputes a legitimate transaction after receiving the goods or services, effectively getting a refund while keeping the product. It's crucial for businesses to understand chargeback fraud, its types, and how to protect themselves.

What is Chargeback Fraud?

Chargeback fraud, also known as "friendly fraud," happens when a customer makes a valid purchase but later claims they didn’t authorize the transaction or didn’t receive the product. They then request a chargeback from the bank, getting a refund while keeping the goods.

Types of Chargeback Fraud

- Friendly Fraud: The most common form, where customers falsely claim a charge wasn’t authorized or the goods weren’t as described.

- Return Fraud: A customer returns a product in good condition but claims it was faulty, seeking a chargeback as well.

- Digital Goods Fraud: Customers dispute charges for digital products like software or online courses after using them.

- Subscription Fraud: Customers dispute recurring charges for subscription services they’ve used, claiming they never authorized it.

How Chargeback Fraud Affects Your Business

Chargeback fraud can lead to:

- Financial Loss: Losing both the product and the payment.

- Increased Costs: Dealing with fraud requires extra resources.

- Damaged Reputation: Fraud can erode customer trust.

- Strained Relationships with Payment Processors: High chargeback rates can result in higher fees or even account termination.

How to Prevent Chargeback Fraud

- Transaction Monitoring: Regularly review transactions for signs of suspicious activity.

- Customer Verification: Use secure verification methods to confirm the customer’s identity.

- Clear Policies: Have transparent refund and return policies to reduce disputes.

- Open Communication: Address customer issues before they escalate to chargebacks.

- Excellent Customer Service: Help customers resolve concerns to avoid disputes.

- Real-Time Fraud Detection: Implement AI-based tools to catch fraudulent transactions before they happen.

Conclusion

Chargeback fraud is a serious risk for businesses, but with the right tools and strategies, it’s preventable. By staying proactive and implementing robust prevention methods, you can protect your business from financial loss and reputational damage. Dispute.com offers comprehensive solutions to help businesses reduce chargeback fraud and keep operations running smoothly. Contact us today to learn more!